Our deep understanding with your investment represents your family's future guided by CAKIR Investment

CAKIR Investment has evolved into a global financial services firm providing both EB-5 and Private Equity investment opportunities. Acting as a fiduciary, we utilize our due diligence processes earned through various market cycles to navigate appropriate deal structures and provide global mobility for our clientele and their capital.

CAKIR Investment has helped over investors to obtain more than green cards for family members. We work with industry leading networks and attorneys to ensure your case receives the best treatment possible from a Source of funds perspective.

| EB-5 Visa Investment Amount | Invested into | Amount* |

|---|---|---|

| Project located in Targeted Employment Area (TEA) EB-5 Investment Amount | US Commercial Enterprise | $800,000 |

| EB-5 Visa Investment Amount | Invested into | Amount* |

|---|---|---|

| Project located in Non-Targeted Employment Area (Non-TEA) EB-5 Investment Amount | US Commercial Enterprise | $1,050,000 |

| EB-5 Visa Typical Costs | Paid to | Amount* |

|---|---|---|

| Admin Fees | Investment Issuer (Regional Center) | Project Variable |

| Legal Fees | Immigration attorney | $25,000 – $35,000** |

| Processing Fees | USCIS | To be determined by USCIS |

Step 1: Understand what EB-5 is and its Timeline

Start by doing your research into the EB-5 process. This immigration by investment program is not the same as other ‘golden visa’ programs offered by other countries as it requires a strict initial source of funds review and

eventually proof of job creation. The investment process takes approximately 3 to 7 years, each EB-5 project will have a separate loan term and payback structure.

Step 2: Does EB-5 work for me?

EB-5 requires you to make a minimum investment of $800,000. If you are on an existing non-immigrant visa in the US right now, you need to decide if the benefits of obtaining a Green Card are greater than renewing your

non-immigrant visa every three years. There is also an additional benefit to those foreign nationals who have an existing nonimmigrant visa like a F-1, H-1B or L1A visa, and are in the US at the time of filing of EB-5 petition, as

they are entitled to concurrent filing for adjustment of status and hence more expedient receipt of EAD Work Authorization (average 3-4 months).

Step 3: My Source of Funds?

One of the most important aspects of the program is to demonstrate where the money you’re investing is coming from. Whether it’s your earnings, assets, or even gifts/loans from friends and family, you will need to prove and show

documentation for all sources of money in the investment and fees. The entire investment amount and all fees must be accounted for and wired into the project before your immigration petition is filed. If you don’t have all the

funds required to invest today, we still encourage you to conduct your research and arrange a consultation with CAKIR Investment. We understand that the EB-5 investment is a long-term life decision for individuals and families, we are

happy to answer any questions as you plan for you and your family’s future.

Step 4: Make your decision

After taking all facts into consideration, base your decision on whether or not the EB-5 program is right for you. CAKIR Investment is happy to refer you to an experienced immigration attorney best fit to handle your petition.

Step 5: Engage an Immigration Attorney and start your Source of Funds process

The first step in your EB-5 process will to be to have an attorney assess your source of funds. Once engaged, your attorney will begin by obtaining your basic info, travel history, and the required documentation for your source of

funds. If your funds are not all liquid the attorney will guide you in mobilizing your funds. The attorney also will outline what documentation you will need to provide for each source, which can include a gift, loan against

property, sale of assets, income, and more. You will need to provide multiple documents at this stage and the entire process can take a few weeks to a few months depending on how quickly you can provide the required documentation.

Step 6: Identify a project that meets your objectives

Complete your due diligence on the project that best meets your immigration and investment goals. We recommend setting up a Zoom call with one of our professionals at CAKIR Investment to review the project options we have available.

Your immigration attorney cannot recommend projects to you, but you can ask them to do their due diligence on the immigration aspect of the project of your choice.

Step 7: Sign documents and send Funds to Escrow

OnAfter your immigration attorney has collected all the required documentation and completed your source of funds they will give you the go ahead to send your investment capital to the project escrow account. Once you sign the

signature packet and wire the funds, we will countersign the documents and issue a wire transfer receipt reflecting the full amount and admin fees were wired to us. This is the final documentation your attorney needs to file

before your I-526E Petition.

Step 8: Submit your I-526E petition

Your lawyer will collect all the necessary documents for your funding source and send them to CAKIR Investment via bank transfer against a receipt. After receiving CAKIR Investment's signed documents, your I-526E petition will be sent to USCIS.

The I-526E Immigrant Petition by Alien Entrepreneur consists of the following

1) Documents proving the EB-5 investor's funds and earnings used for immigration.

2) The employment of 10 people required for the investor and his family members to receive immigration assistance will be provided by YDY CONSTRUCTION through CAKIR Investment funds.

Approximately 10 days after you submit the application, you will receive an I-797C confirmation from USCIS stating that they have received your petition (this timeline may vary). The receipt notification will include the date they received your petition and this will be your official “Priority Date.” At this point, if you are in the United States on a nonimmigrant visa, your attorney may also advise you to apply for an Adjustment of Status, which will allow you to receive an EAD Work Authorization and Advance Parole. Travel Authorization before your petition is approved.

Rural Priority I-526E Processing: Projects with rural TEA designation receive Priority I-526E processing. To date, investors have an average transaction time of 6 months in Rural Projects.

Non-Rural I-526E Processing: We have not seen post-RIA I-526E Approvals for Non-Rural Projects, processing times are unknown.

Step 9: Wait for USCIS to approve your I-526E petition

This process varies in time and cannot be controlled. This wait time can be dependent on the project you subscribe to, and the order of approval is not always completed in the exact order of when each person filed their I-526E

petition. If you are outside the US you are not given any legal immigration status during this time.

During this time CAKIR Investment will send you access to your respective project portal where you will be able to monitor the progress of your investment, receive important tax documents, and enter the bank information for receiving

your interest payments.

Step 10: Wait for Employment Authorization Document (EAD) and Advanced Parole (AP) Travel permit (For applicants in the US on a nonimmigrant work or student visa only)

This step only applies to EB-5 petitioners who are in the United States on a nonimmigrant visa such as an F-1 or H-1B visa. While your I-526E petition is pending you may apply for Adjustment of Status (depending on visa

availability for your country) and wait for your EAD and AP cards to arrive. Please make sure to consult with your immigration attorney to understand the benefits it provides and what you should do while your I-526E petition

remains pending.

Step 11: Consular Processing / Change of Status If you are outside the US you will go through a visa interview process with the Visa Consular (includes document review, medical examination, and personal interview). This will take approximately 6 months to set up depending on your local consulate. After the interview you will receive an immigrant visa that will be stamped into your passport, you are then able to move to the United States. After you arrive in the US your Green Card will then be issued to you. If you reside in the US and file for Adjustment of Status, you will not need to complete an interview and you will receive your Green Card in the mail approximately 6-12 months after I-526E approval.

Step 12: Begin 2-year Conditional ResidencyOnce you receive your Green Card in the mail it is effectively the same as any normal permanent resident card. The conditions that must be met at the end of the two years to make the Green Card permanent are: 10 jobs must be created using your investment and your money must be “at-risk” for 2 years. On October 11th, 2023, the USCIS redefined this 2-year at-risk condition to be 2 years from the date an investor has fully funded the NCE and filed their petition. At CAKIR Investment we always structure our investments with a large job creation buffer so more than enough jobs are created for our investors. Receiving the return of your investment depends on the project you have selected and its repayment terms.

Step 13: File I-829 for removal of your conditions

During the last 90 days of your 2-year Conditional Residency your attorney will file your I-829 petition. You will remain in the US as a Green Card holder while your I-829 is being processed.

Step 14: Receive Unconditional Green Card once the I-829 is approved.

At this point your EB-5 journey is complete. Once you have resided permanently in the US for 4 years 9 months (starting from the time you obtained your conditional residence status), you are eligible to file for US citizenship.

Speak with your immigration counsel on the next steps if you so desire.

An EB-5 visa is a US immigrant visa (meaning US permanent residency). Another name for a permanent residency visa is a “Green Card”. Green Cards are issued primarily through a lottery, Family-Based relationships, or an Employment-Based sponsorship. EB-5 stands for Employment-Based 5th Category Visa and is an immigration by investment program which leads to US job creation or “Employment”.

An EB-5 petitioner is an individual investor. Investors’ spouses and unwed children under 21 can also obtain a Green Card through the same investment. Minors are allowed to apply.

Immigrant investor programs are programs designed to attract foreign capital and businesspeople by providing the right to residence and citizenship in return. The United States remains one of the most attractive countries to immigrate to and the EB-5 Regional Center program is highly favored amongst foreign nationals looking to move to the United States. If you're on a H-1B/F-1/L-1A or any other non-immigrant type visa, obtaining a Green Card via the EB-5 program is the best way to secure you and your family’s future in the United States. Even though you may have an EB-2/3 petition pending, the current wait times are long and can often result in you not being able to obtain a Green Card. Obtaining a Green Card also removes the threat of constant non-immigrant visa renewals every three years and greatly lowers the risk of having to leave the country if there is a change with your visa program, job, or personal life in any way. Using EB-5 to speed up the Green Card process is especially important for individuals on H-1B status who must continuously extend their status and contend with limited career flexibility.

Each investor must invest $800,000 (if investing in a Targeted Employment Area “TEA”) or $1.05 million in a non-TEA project and create 10 US jobs. The initial EB-5 Green Card is conditional and temporary. At the end of a 2-year conditional residency period, the investor must show that the investment was maintained and at least 10 jobs were created for the Green Card to become permanent.

Proper documentation of source of funds is critical, and funds required for the investment may include, but are not limited to:

You can utilize loans and it is best practice loans be secured by an asset. Funds can be sourced from anywhere in the world if they legally belong to the investor.

The EB-5 Regional Center program was created in 1993 to allow multiple investors to pool their capital for enhanced economic impact within a defined geographic area. This also allowed EB-5 investors to make a passive investment with Regional Centers and issuers who had knowledge and expertise in EB-5.

The goal of a typical EB-5 investor is to obtain a Green Card and receive their investment principal back. Well-structured EB-5 offerings have a structured exit strategy in which the EB-5 investors are repaid in-full plus interest. The capital must remain invested or “at-risk” until the investor has completed their Conditional Residency, if they fail to do so their Green Card will not become permanent. Even though EB-5 investments need to be “at-risk” that does not mean that the investment needs to be inherently “risky”.

EB-5 projects assume many different business models and operate within many different industries. Types of EB-5 projects include:

Most EB-5 investments tend to include real estate development as job creation as it is easiest to create jobs with construction.

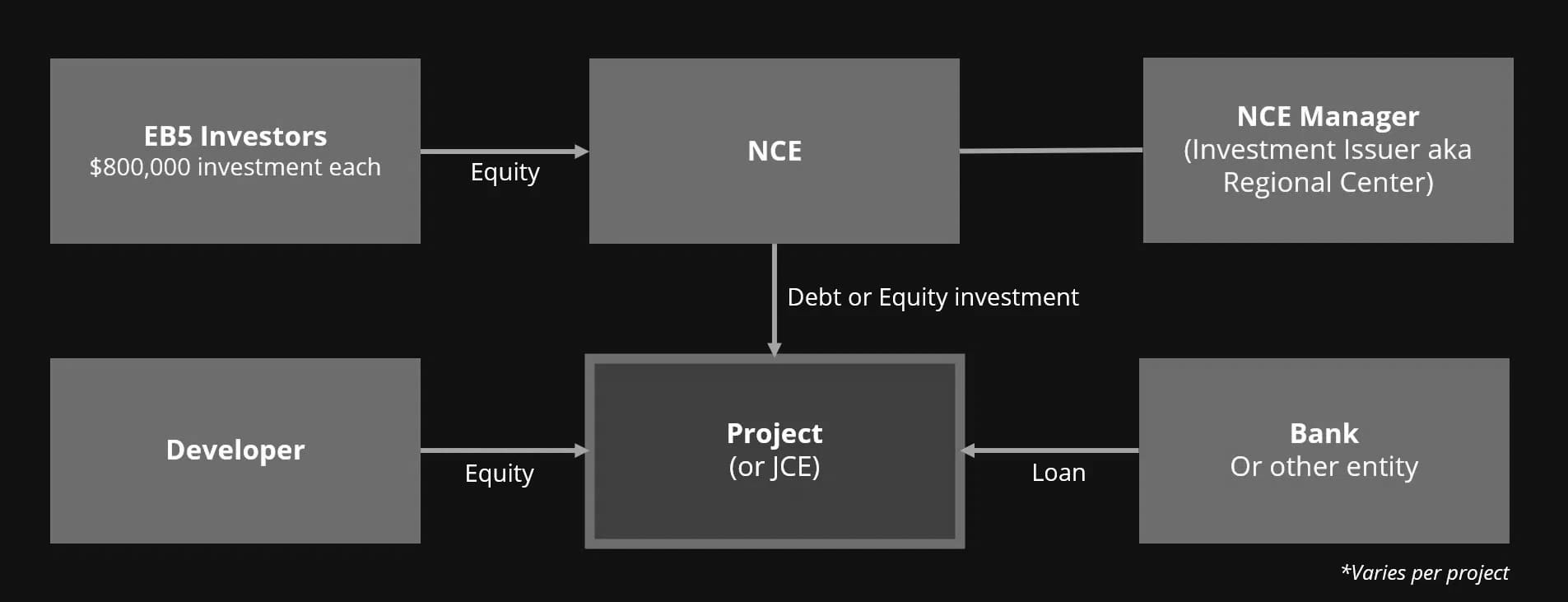

New Commercial Enterprise: The New Commercial Enterprise (NCE) is the entity created into which the EB-5 investors invest. The NCE Manager is the issuer of the security and manages the New Commercial Enterprise into which the investors invest. The invested capital is then deployed as a loan or as equity to the Job Creating Entity.

Job Creating Entity (JCE): This is the project entity where the jobs will be created. In a typical EB-5 project each EB-5 investor buys one share of the NCE. From there the investors’ money is pooled together and either loaned or invested in the form of equity into the EB-5 project. The remaining amount required to complete the project may come from a developer, bank loan, grant, investment fund, or any other source of capital.

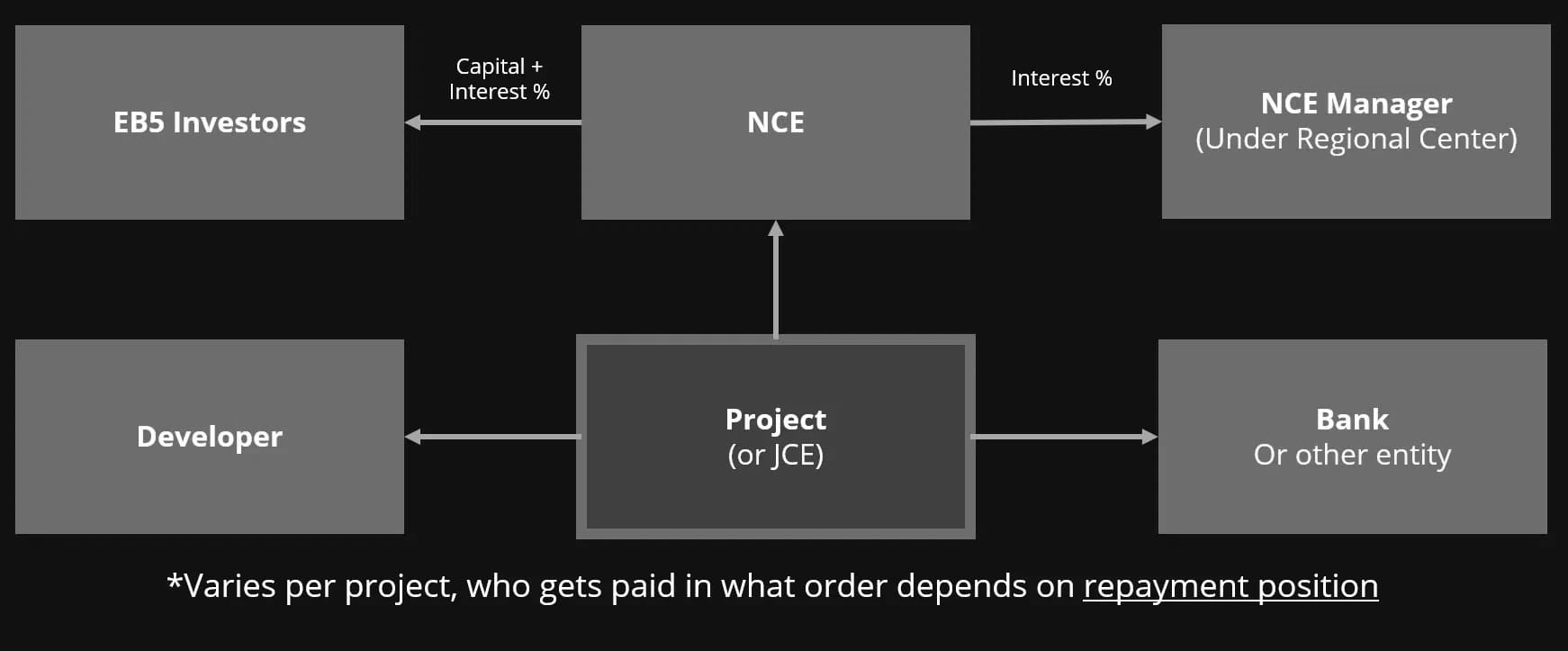

A “Loan” model project is a project in which the NCE makes a loan to the project. Each project will have a coupon rate and loan term/maturity date. The coupon rate is paid throughout the loan term beginning on the loan start date. A typical EB-5 project will have a loan term of 5 to 7 years.

An “Equity” model project is a project in which the NCE makes a Preferred, Pari Passu, or any other form of Equity investment into the project. Equity projects generally have more risk but can potentially earn the investor a higher return if the business is successful. In a pure equity investment, there is no maturity date to payback the investor, but rather the investor shares in the project’s cash flows, and the return of capital is dependent upon the sale or refinance of the project.

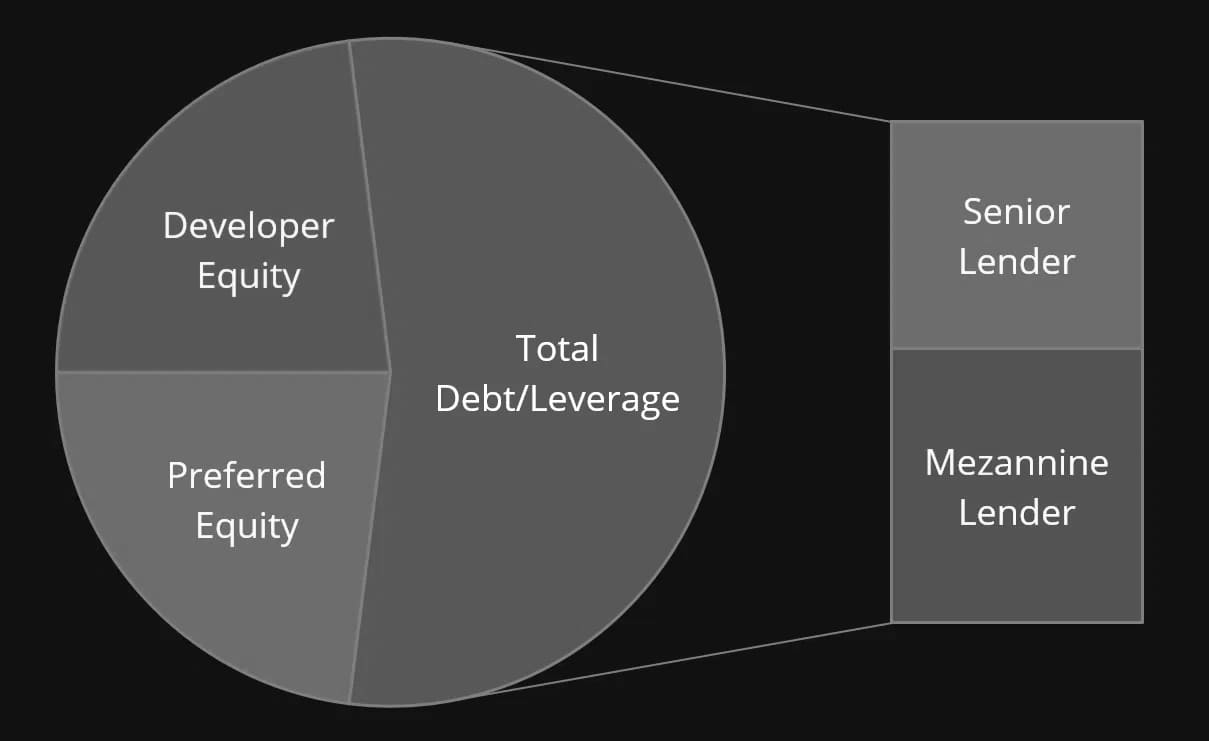

Senior Lender: The Senior Lender is first in line to be paid back, they hold the first position or right to foreclose on the property if there is a default on the loan agreement. This means in the event of a project failure; the first position lender can take over ownership of the development property and liquidate to recover its money. This is often a bank but sometimes is the EB-5 fund.

Secondary or Mezzanine Lender: The Secondary or Mezzanine Lender holds second position and therefore is second in line to be paid back, the Senior Lender will be paid back in full prior to the second lender recovering any money. Most EB-5 project loans are secured in second position, so it is important to know the size of the senior loan.

Preferred Equity Position: Preferred Equity investors will receive profits from the project until their preferred return is paid. This also means that return is dependent on the project returning a profit unlike a loan where interest is earned when funds are lent to the developer. You also are relying on the NCE liquidating through a sale or refinance to recover your investment, and there may not an investment maturity date. There are many ways to structure Preferred Equity offerings, please review the offering documents for each individual project to obtain the true structure of the investment.

Pari Passu Equity Position: Pari Passu Equity is a profit sharing split between the NCE Manager and/or developer and the investor. This can be the riskiest portion of the capital stack as you are relying on profits to pay the return. Under this structure you are generally relying on a sale of your share of the NCE to recover your investment.

Where your money is in the capital stack will decide the risk and return profile of your investment. Other primary aspects to consider are the current value of the asset during construction, how far along construction is, and the likelihood of construction completion.

An EB-5 investor must invest the required amount of capital in a new commercial enterprise that will create full-time positions for at least 10 qualifying employees.

Rather than count 10 hired employees, the USCIS allows Regional Centers to use multiple economic impact formulas to connect money spent on a project with the number of jobs created. This means if the money is spent on the project as specified the jobs are created and are permanent.

A TEA can be, at the time of investment, either:

A rural area is any area other than an area within a metropolitan statistical area (MSA) (as designated by the Office of Management and Budget) or within the outer boundary of any city or town having a population of 20,000 or less??? according to the most recent decennial census of the United States.

A high-unemployment area may be any of the following areas

A high-unemployment area may also consist of the census tract or contiguous census tracts in which the new commercial enterprise is principally doing business. This may include any or all directly adjacent census tracts, if the weighted average unemployment for the specified area based on the labor force employment measure for each tract is 150% of the national unemployment average.

Source: USCIS

CAKIR Investment works with well capitalized developers to structure high-quality EB-5 investment products for foreign investors. CAKIR Investment’s goal is to ensure its qualifying EB-5 investment products provide more than enough of the requisite jobs for all investors. The use of investor protections and industry best-practices provide CAKIR Investment investors with peace-of-mind. CAKIR Investment’s principals have helped over 1000+ investors obtain more than 2,000 Green Cards for family members with a 100% I-526 and I-829 approval rate.